A group of 23 First Nations & Metis Settlements has just made a large significant investment in seven Enbridge-operated pipelines.

The newly formed Athabasca Indigenous Investments has acquired an 11.57 percent interest in seven Enbridge-operated pipelines in the Athabasca region of northern Alberta for $1.12 billion. This investment represents the largest energy-related Indigenous economic partnership transaction in North America to date.

The pipelines included in the deal are the Athabasca Pipeline, Athabasca Twin and Wood Buffalo Extension Pipelines, Norlite Diluent Pipeline, Waupisoo Pipeline, Wood Buffalo Pipeline, Woodland Pipeline, and Woodland Extension Pipeline.

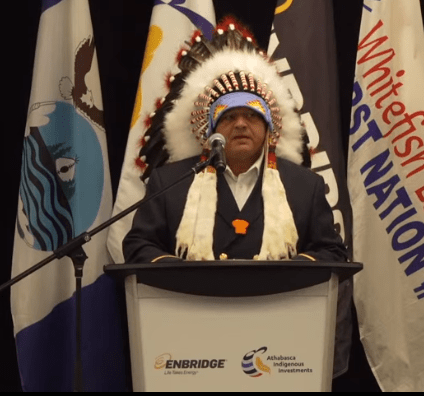

“This is a truly historic day for our communities in the Athabasca region,” says Chief Greg Desjarlais of Frog Lake First Nation. “In addition to an opportunity to generate wealth for our people, this investment supports economic sovereignty for our communities. We look forward to working with a leading energy company like Enbridge, which shares Indigenous values of water, land, and environmental stewardship.”

“It’s going to allow us to send our kids to school. It’s going to allow us to send more people to treatment. It’s going to allow us to deal with the mental (health) crisis that we have in our communities, the anxiety of the young people.”

Al Monaco, President and Chief Executive Officer of Enbridge says they are very pleased to be joining our Indigenous partners in this landmark collaboration

“We believe this partnership exemplifies how Enbridge and Indigenous communities can work together, not only in stewarding the environment but also in owning and operating critical energy infrastructure. We are looking forward to working with the Aii and deepening our relationship well into the future. This also fully aligns with our priority to recycle capital at attractive valuations, which can be used to fund numerous growth opportunities within our conventional and low carbon platforms.”